DeFund V1 SDK is now released!

DeFund V1 SDK includes Swap-related functions, which can make it easier for you to develop and manage your funds. You can interact with our contracts independently and create your own strategies without using the user interface we provide. The SDK supports mainnet, polygon, goerli and mumbai at the same time, you can choose the chain you want to manage the fund. For details about the SDK, please refer to the Developers.

What is DeFund Protocol ?

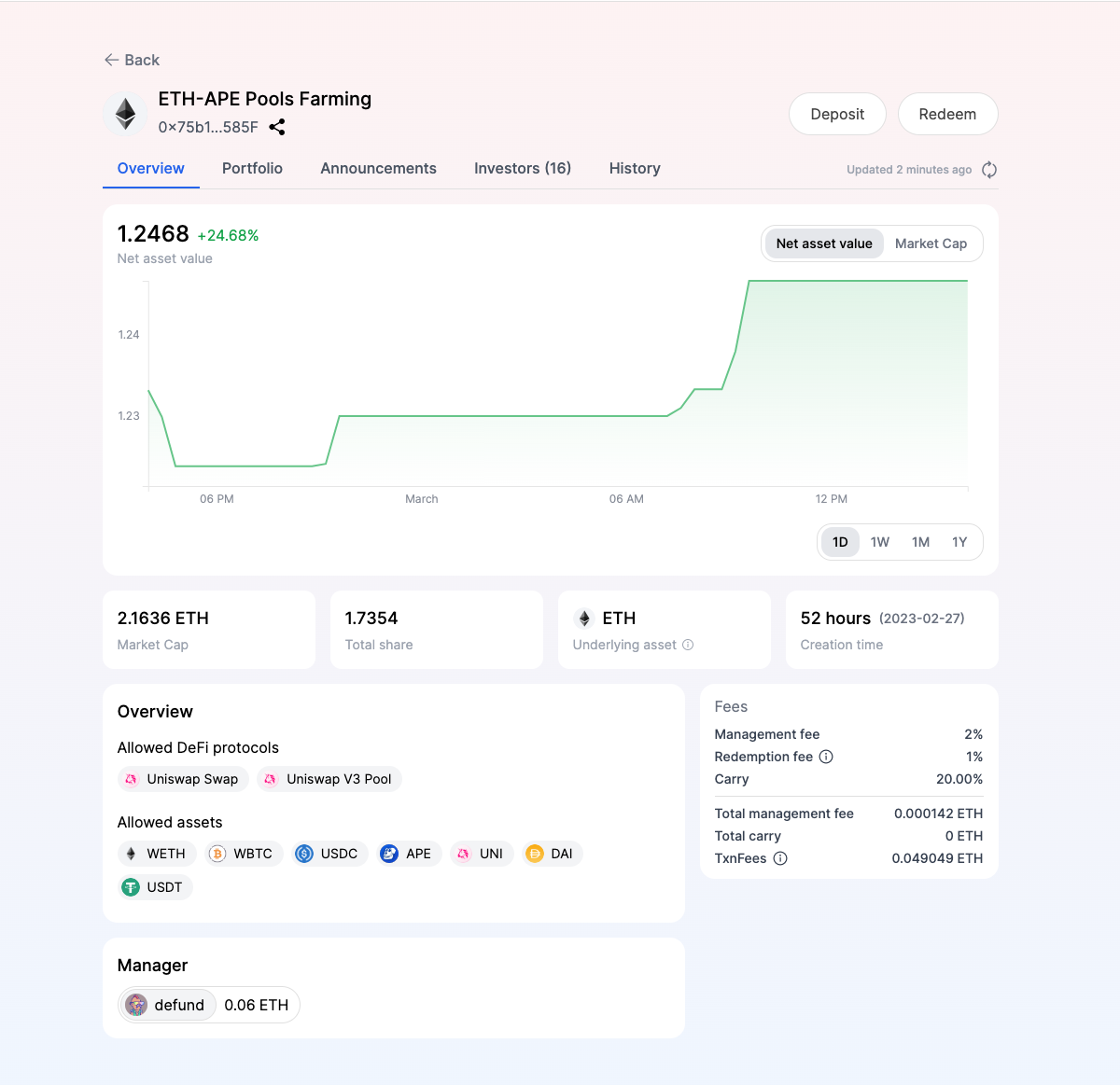

DeFund Protocol is a decentralized fund investment protocol. It consists of a series of smart contracts that allow anyone to use contracts to manage the fund's assets, enabling decentralized investing.

DeFund Protocol consists of smart contracts on Ethereum for decentralized fund management. Users may interact with the contract at any time to implement fund operations without any third party’s authorization or permission.

DeFund Protocol opens in a new tab with Uniswap. The protocol breaks new limits by linking Uniswap's exchange and liquidity market makers, ensuring not only decentralization, but also perpetuation using the permissionless liquidity provided by Uniswap V3. Whether you are bullish, bearish, or volatile, you can achieve higher returns with different strategies.

Protocol Income

By setting the dual rate of Management fee and Carry, the protocol enables both GP and LP to obtain higher returns, and LP does not have to worry about the security of funds. All funds are in the contract, and it has the right to redeem its own funds at any time. LP may also deposit or redeem at any time, depending on the Fund's returns, all without the consent or authorization of any third party.

What is the difference between DeFund and traditional funds?

- The fund will never expire and will be valid forever

- Deposit at any time, redeem at any time, get to your account immediately

- Anyone can participate in the investment or operation of the fund without any requirements

- No counterparty trading is involved

- There is no assets requirement, you can choose any fund that meets the requirements to deposit

Should I use DeFund?

Funds are one of the most traded instruments in traditional finance. They can be used to hedge portfolios, lower investment barriers, reduce investment risks, and help users achieve better asset returns.

The emergence of the fund reduces the investment risk of users. They do not need to have professional fund knowledge and rich industry experience. Professional fund managers manage and operate the fund to achieve higher investment returns.

Experienced and professional blockchain fund managers can also gain more profits by operating funds, and manage fund assets through smart contracts, which do not require high asset or endorsement by fund companies, and everything is based on data.

Thus, DeFund can create value for:

Retail investors can invest in funds just like buying tokens. By sifting through the list of DeFunds, they can find the funds they like, go to the details page, and click "Deposit" to buy. Depending on the market at the time, you can choose to deposit funds with different benchmarks to maximize returns.

Compared with ordinary retail investors, professional investors usually have more knowledge about DeFi and can better find excellent funds from numerous funds to earn higher returns. Meanwhile, professional investors can also become fund managers and provide fund services for other users to earn profits.

Adequate liquidity is a must for all DeFi applications, and DeFund is no exception. More market makers or Uniswap V3 LP can gain not only Uniswap revenue by providing liquidity on the DeFund platform, but also gain additional revenue as a GP.

Institutions may need to hedge their portfolio exposure to reduce overall portfolio risk. They can hedge their bets by buying stablecoins or ETH, WBTC or USDC or DAI to be bullish or bearish.

Generally, the Treasury funds of DAO organizations have poor liquidity, and there is no way to realize the increase of value. Through DeFund, DAO can invest in relatively safe assets, and at the same time, DAO funds can be opened to realize additional income from DeFund.

What are the risks

Although the fund has a higher safety factor than traditional stocks, it is also a risk investment product, so it cannot guarantee a certain profit. The net value of the fund will also change with market fluctuations. If the market fluctuates violently in a short period of time, it may cause greater losses. Therefore, every user who uses DeFund should understand the security risks behind the fund.

vision

The core vision of the agreement is to realize a completely decentralized fund investment agreement, and rely on the existing decentralized DeFi agreement to build a more powerful DeFi application, so that LP and GP can manage assets more conveniently and quickly, and increase funds usage efficiency.